[INTERVIEW] CIBC Enhances Aventura Rewards

Today, we are featuring Megan Jones, Vice President of Card Product Development & Benefits Strategy at CIBC, who will share with us how they simplifyed the Aventura Rewards program. Thank you Megan for taking the time to answer our questions and to celebrate our upcoming 10 year anniversary!

1) Please tell us about yourself and your role with CIBC?

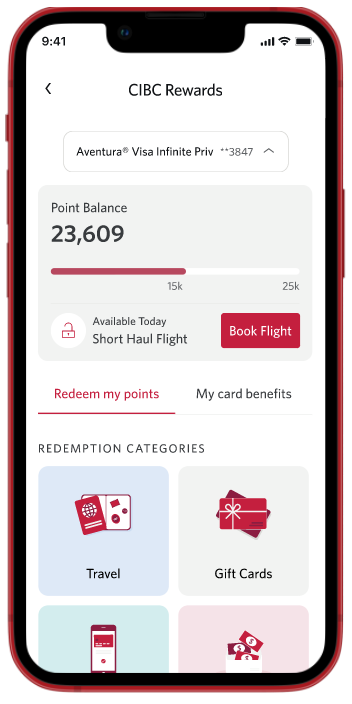

I’m Megan Jones, Vice President of Card Product Development & Benefits Strategy at CIBC. My team’s focus is on ensuring that our credit cards offer the best suite of products for our clients – whether that’s travel rewards, cash back or no annual fees – we help make every cent count. We recently launched the CIBC Rewards hub for Aventura clients that enables them to access benefits, track points or make instant redemptions all in one spot through mobile or online banking, making it easy for clients to understand and access the full value of the program.

2) For people who are new to CIBC, how does the Aventura Rewards program work?

It’s easy, you can apply for an Aventura credit card online or in person at one of our Banking Centre locations, and you are automatically enrolled in the CIBC Rewards program. All that’s left is to start earning points on each eligible transaction. Clients are also able to take advantage of multipliers that accelerate points earned on categories such as Gas, EV charging, Groceries and travel bookings through CIBC Rewards. You can use your accumulated Aventura points for a variety of options, including travel, merchandise, gift cards, or use the points to pay for any purchase or contribute to select CIBC financial products, like a mortgage or RRSP. You can log in to CIBC online or mobile banking at any time to view your points, make instant redemptions, and view all of your card benefits, all in one convenient location.

3) I understand that you made some new enhancements to the program?

We wanted to further simplify the experience for our clients when accessing their CIBC Aventura Rewards. This new hub makes it even easier to find what you’re looking for, and see all of your redemption and credit card benefit options in one location. Our team is continually looking at ways to transform the digital experience for our clients and build on existing features that help our clients get the most out of their reward ambitions. A new feature that we’re excited about is being able to quickly access airport lounges, Nexus passes and insurance coverage in one spot through CIBC Rewards.

4) What else can cardholders look forward to with Aventura?

We are continuing to build on CIBC’s suite of digital tools both in the mobile banking app and through online banking to help clients do more with their finances. The launch of the new CIBC Rewards hub will be multi-phased to enhance the digital experience of the program. Clients can expect to see additional enhancements rolled out in the coming months to make it easier to access and redeem points, and expand information and access to card benefits.

5) We are closing in on our ten-year anniversary. Do you have any thoughts for us as we embark on our next 10 years?

Congratulations on a big milestone and your success over the past decade! Pointshogger helps inform Canadians of the options available and helps them choose the product that suits their needs. Our team is pleased to be part of Pointshogger’s journey and we look forward to seeing what the next 10 years bring!

It would have been nice to hear about their partnership plans with Ultramar and the Journie. CIBC Aventura and Aeroplan infinite cards earn extra points on gas and ev charging but so does their competition I think it would’ve been smart to mention their partnership with Ultramar which gives the 3 cent discount per litre, earn Journie points and earns either Aeroplan or Aventura points. Compared to RBC and Petro Canada and the BMO and Shell. As well as TD which earns points but has no gas station partnership. I think the CIBC Ultramar partnership and maybe the RBC Petro Canada partnerships are the strongest regarding points value and savings in Canada.I feel that CIBC is the only company that really helps Canadians as mentioned in one of their answers make every cent count especially for those who have a chequing account and premium cc.

Thank you for your response David. I am also a fan of Journie rewards, so I will definitely pass on the feedback to CIBC as well as take into consideration going forward.

In the meantime, this was my most recent post on CIBC and Journie rewards: https://pointshogger.com/rundown-of-journie-rewards-march-14-2023/

Can definitely expand on that post in the future!